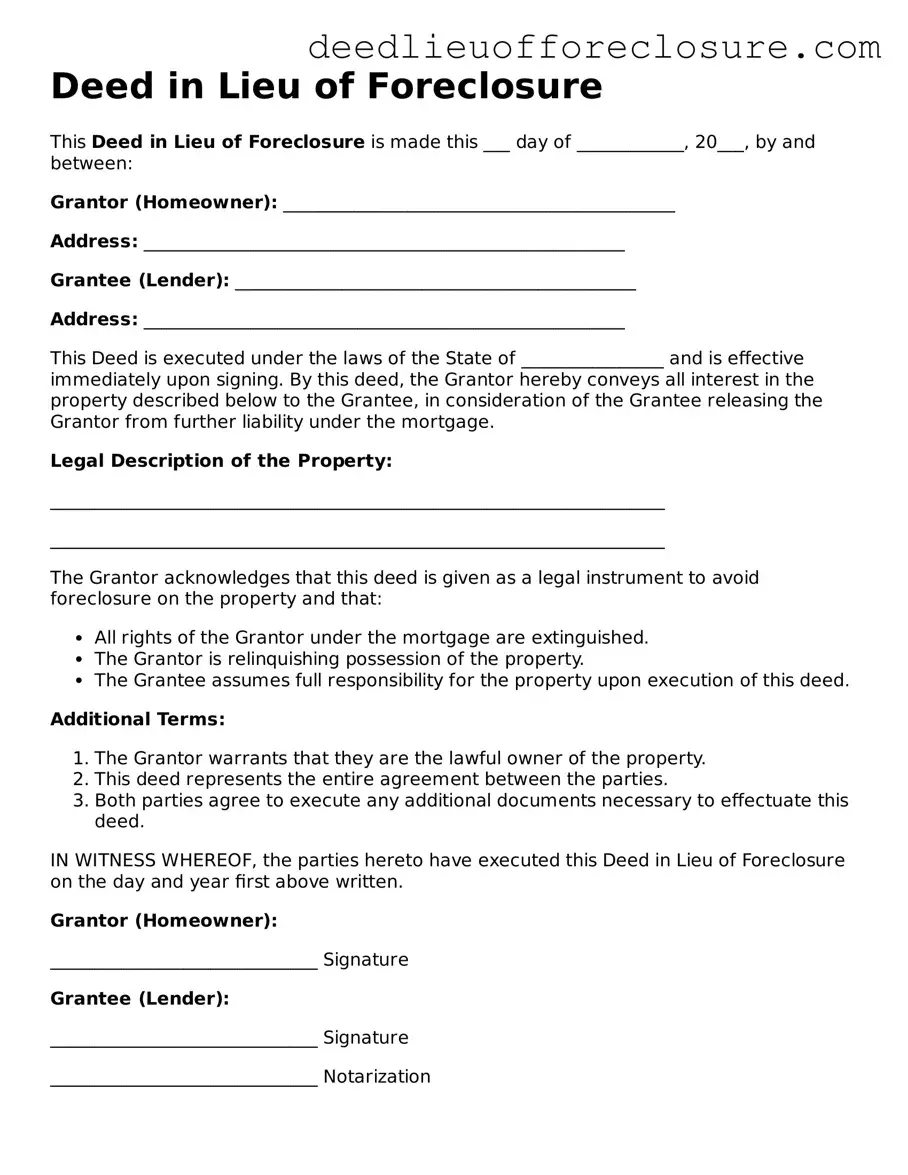

Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is made this ___ day of ____________, 20___, by and between:

Grantor (Homeowner): ____________________________________________

Address: ______________________________________________________

Grantee (Lender): _____________________________________________

Address: ______________________________________________________

This Deed is executed under the laws of the State of ________________ and is effective immediately upon signing. By this deed, the Grantor hereby conveys all interest in the property described below to the Grantee, in consideration of the Grantee releasing the Grantor from further liability under the mortgage.

Legal Description of the Property:

_____________________________________________________________________

_____________________________________________________________________

The Grantor acknowledges that this deed is given as a legal instrument to avoid foreclosure on the property and that:

- All rights of the Grantor under the mortgage are extinguished.

- The Grantor is relinquishing possession of the property.

- The Grantee assumes full responsibility for the property upon execution of this deed.

Additional Terms:

- The Grantor warrants that they are the lawful owner of the property.

- This deed represents the entire agreement between the parties.

- Both parties agree to execute any additional documents necessary to effectuate this deed.

IN WITNESS WHEREOF, the parties hereto have executed this Deed in Lieu of Foreclosure on the day and year first above written.

Grantor (Homeowner):

______________________________ Signature

Grantee (Lender):

______________________________ Signature

______________________________ Notarization