Valid Deed in Lieu of Foreclosure Form for Arizona State

When facing the daunting prospect of foreclosure, many homeowners in Arizona seek alternatives to protect their financial futures. One such alternative is the Deed in Lieu of Foreclosure, a legal process that allows a homeowner to voluntarily transfer ownership of their property back to the lender, thereby avoiding the lengthy and often stressful foreclosure process. This arrangement can provide a fresh start for the homeowner, as it typically alleviates the burden of a mortgage that has become unmanageable. The Deed in Lieu of Foreclosure form outlines essential details, including the names of the parties involved, a description of the property, and the specific terms of the transfer. By signing this document, the homeowner not only relinquishes their rights to the property but may also negotiate certain protections, such as a waiver of deficiency judgments, which can help mitigate the financial impact of the loss. Understanding the nuances of this form is crucial for homeowners considering this option, as it can significantly influence their post-foreclosure experience and pave the way for a smoother transition to new housing opportunities.

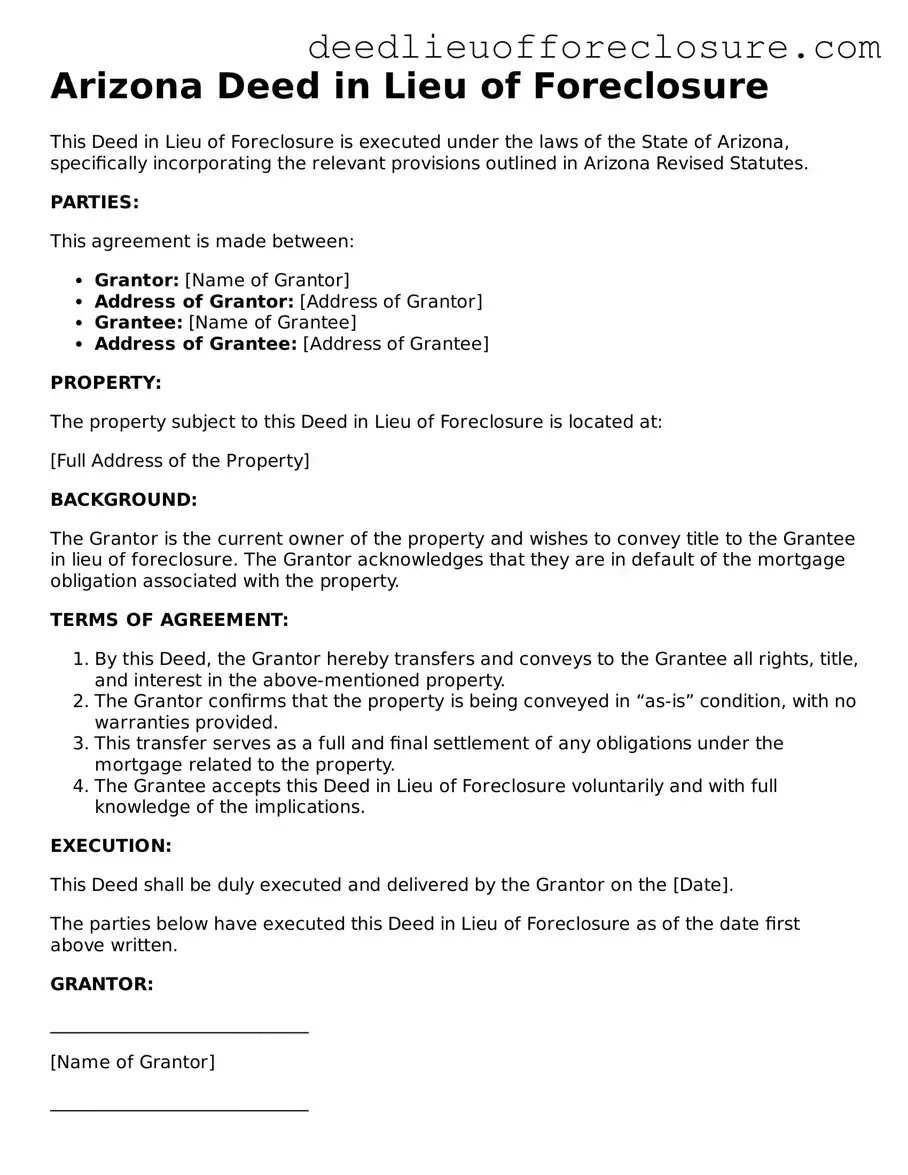

Document Preview Example

Arizona Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is executed under the laws of the State of Arizona, specifically incorporating the relevant provisions outlined in Arizona Revised Statutes.

PARTIES:

This agreement is made between:

- Grantor: [Name of Grantor]

- Address of Grantor: [Address of Grantor]

- Grantee: [Name of Grantee]

- Address of Grantee: [Address of Grantee]

PROPERTY:

The property subject to this Deed in Lieu of Foreclosure is located at:

[Full Address of the Property]

BACKGROUND:

The Grantor is the current owner of the property and wishes to convey title to the Grantee in lieu of foreclosure. The Grantor acknowledges that they are in default of the mortgage obligation associated with the property.

TERMS OF AGREEMENT:

- By this Deed, the Grantor hereby transfers and conveys to the Grantee all rights, title, and interest in the above-mentioned property.

- The Grantor confirms that the property is being conveyed in “as-is” condition, with no warranties provided.

- This transfer serves as a full and final settlement of any obligations under the mortgage related to the property.

- The Grantee accepts this Deed in Lieu of Foreclosure voluntarily and with full knowledge of the implications.

EXECUTION:

This Deed shall be duly executed and delivered by the Grantor on the [Date].

The parties below have executed this Deed in Lieu of Foreclosure as of the date first above written.

GRANTOR:

_____________________________

[Name of Grantor]

_____________________________

[Signature of Grantor]

_____________________________

[Date]

GRANTEE:

_____________________________

[Name of Grantee]

_____________________________

[Signature of Grantee]

_____________________________

[Date]

This instrument, when recorded, shall be a legal conveyance of the property under the laws of Arizona.

PDF Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers the title of their property to the lender to avoid foreclosure. |

| Purpose | This form is used to resolve mortgage defaults without going through the lengthy foreclosure process. |

| Governing Laws | Arizona Revised Statutes (ARS) § 33-811 and § 33-812 govern the process and requirements for deeds in lieu of foreclosure. |

| Eligibility | Homeowners facing financial hardship or unable to make mortgage payments may qualify for this option. |

| Process | The borrower must negotiate with the lender and complete the necessary paperwork to execute the deed. |

| Advantages | It can help preserve the borrower's credit score and expedite the resolution of mortgage debt. |

| Disadvantages | Borrowers may still face tax implications and may not be eligible for future loans easily. |

| Notifying Creditors | Borrowers should inform all creditors about the deed in lieu of foreclosure to avoid further complications. |

| Legal Advice | It is advisable for borrowers to seek legal counsel before proceeding with a deed in lieu of foreclosure. |

Dos and Don'ts

When filling out the Arizona Deed in Lieu of Foreclosure form, it is essential to approach the process with care. Here are some important dos and don'ts to keep in mind:

- Do ensure that all information is accurate and complete.

- Do provide a clear description of the property involved.

- Do consult with a legal professional if you have questions.

- Do keep copies of all documents for your records.

- Don't rush through the form; take your time to review.

- Don't leave any sections blank unless instructed to do so.

- Don't sign the document without understanding its implications.

By following these guidelines, you can help ensure that the process goes smoothly and that you understand your rights and responsibilities.

Other Common State-specific Deed in Lieu of Foreclosure Forms

California Pre-foreclosure Property Transfer - When executed correctly, the Deed provides both parties with closure and a clear path forward.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Transforming the property deed can give homeowners a sense of closure during a challenging financial time.

Key takeaways

When considering the Arizona Deed in Lieu of Foreclosure form, it is important to keep several key points in mind:

- Understanding the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure proceedings.

- Eligibility Criteria: Homeowners should confirm that they meet the lender's eligibility requirements, which may include being in default on the mortgage and having no other liens on the property.

- Impact on Credit: This option can still affect a homeowner's credit score, although it may be less damaging than a foreclosure.

- Legal Considerations: It is advisable to seek legal advice before completing the form to understand all implications and ensure that the process is executed correctly.

- Documentation Requirements: Homeowners must provide necessary documentation to the lender, which may include financial statements and proof of hardship.