Valid Deed in Lieu of Foreclosure Form for California State

The California Deed in Lieu of Foreclosure form serves as a critical tool for homeowners facing financial distress and the looming threat of foreclosure. This legal instrument allows a property owner to voluntarily transfer ownership of their property back to the lender, effectively avoiding the lengthy and often painful foreclosure process. By executing this deed, the homeowner relinquishes their rights to the property, which can provide a swift resolution to an otherwise challenging situation. In exchange, the lender may agree to release the homeowner from their mortgage obligations, potentially alleviating the burden of debt. Key aspects of this form include the requirement for the homeowner to be current on their mortgage payments, the need for the lender's acceptance, and the stipulation that the property must be free of liens. Additionally, the form outlines the implications for credit scores and future borrowing potential, making it essential for homeowners to fully understand the consequences of this decision. Overall, the California Deed in Lieu of Foreclosure offers a viable alternative for those seeking to navigate the complexities of financial hardship while minimizing the impact on their future.

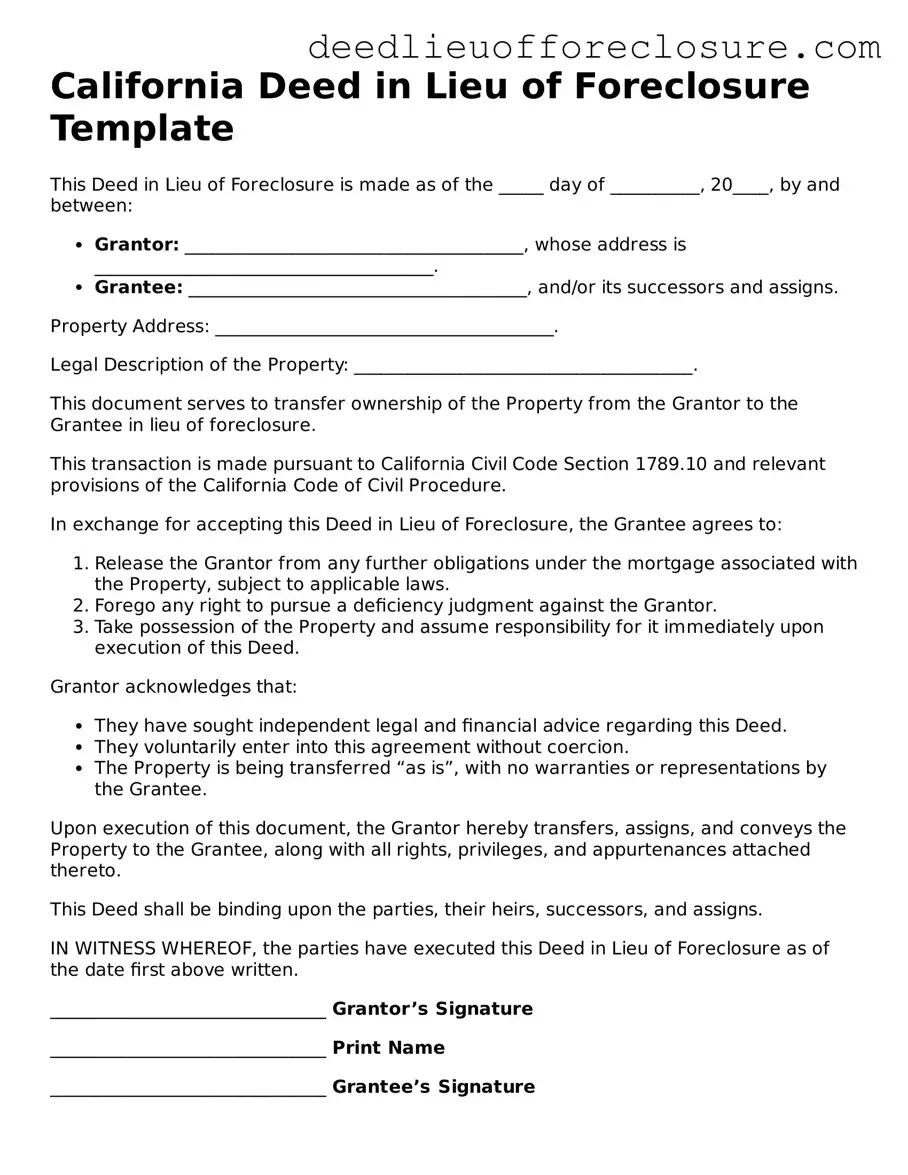

Document Preview Example

California Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made as of the _____ day of __________, 20____, by and between:

- Grantor: ______________________________________, whose address is ______________________________________.

- Grantee: ______________________________________, and/or its successors and assigns.

Property Address: ______________________________________.

Legal Description of the Property: ______________________________________.

This document serves to transfer ownership of the Property from the Grantor to the Grantee in lieu of foreclosure.

This transaction is made pursuant to California Civil Code Section 1789.10 and relevant provisions of the California Code of Civil Procedure.

In exchange for accepting this Deed in Lieu of Foreclosure, the Grantee agrees to:

- Release the Grantor from any further obligations under the mortgage associated with the Property, subject to applicable laws.

- Forego any right to pursue a deficiency judgment against the Grantor.

- Take possession of the Property and assume responsibility for it immediately upon execution of this Deed.

Grantor acknowledges that:

- They have sought independent legal and financial advice regarding this Deed.

- They voluntarily enter into this agreement without coercion.

- The Property is being transferred “as is”, with no warranties or representations by the Grantee.

Upon execution of this document, the Grantor hereby transfers, assigns, and conveys the Property to the Grantee, along with all rights, privileges, and appurtenances attached thereto.

This Deed shall be binding upon the parties, their heirs, successors, and assigns.

IN WITNESS WHEREOF, the parties have executed this Deed in Lieu of Foreclosure as of the date first above written.

_______________________________ Grantor’s Signature

_______________________________ Print Name

_______________________________ Grantee’s Signature

_______________________________ Print Name

State of California

County of ______________________

On this _____ day of __________, 20____, before me, _________, a Notary Public in and for said State, personally appeared ______________________, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that they executed the same in their authorized capacity, and that by their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

WITNESS my hand and official seal.

_______________________________

Notary Public Signature

PDF Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Laws | This process is governed by California Civil Code Sections 1475-1485, which outline the requirements and procedures for executing a deed in lieu of foreclosure. |

| Benefits | Homeowners may benefit from a Deed in Lieu of Foreclosure by avoiding the lengthy foreclosure process and potentially minimizing damage to their credit score. |

| Eligibility | To qualify, homeowners typically must demonstrate financial hardship and have no other liens on the property, although specific lender requirements may vary. |

Dos and Don'ts

When filling out the California Deed in Lieu of Foreclosure form, it’s crucial to follow certain guidelines to ensure a smooth process. Here’s a list of things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate information about the property and the parties involved.

- Do consult with a legal professional if you have questions.

- Do sign the document in the presence of a notary public.

- Don't rush through the form; take your time to ensure everything is correct.

- Don't leave any sections blank unless instructed otherwise.

- Don't forget to keep a copy of the completed form for your records.

Other Common State-specific Deed in Lieu of Foreclosure Forms

Deed in Lieu of Forclosure - Borrowers considering this option should consult financial advisors or legal experts for potential impacts.

Deed in Lieu of Foreclosure Sample - A written agreement detailing the terms of the Deed in Lieu can help prevent future misunderstandings.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - This form provides a way for homeowners to settle their mortgage debt without undergoing the foreclosure process.

Foreclosure in Georgia - The deed in lieu is a tool for responsible financial management during times of significant debt stress.

Key takeaways

When dealing with the California Deed in Lieu of Foreclosure form, it’s important to understand several key aspects. Here are some essential takeaways:

- The Deed in Lieu of Foreclosure allows homeowners to voluntarily transfer their property to the lender to avoid foreclosure.

- This process can help preserve the homeowner's credit score, as it may be viewed more favorably than a foreclosure.

- Homeowners should ensure that they are fully aware of their mortgage obligations before proceeding with this option.

- It is crucial to communicate openly with the lender throughout the process to understand any specific requirements.

- Legal advice can be beneficial. Consulting with a real estate attorney may help clarify potential implications.

- After the deed is signed, the lender typically cancels the mortgage debt, but homeowners should confirm this in writing.

- Homeowners should be prepared for the possibility of tax implications, as forgiven debt might be considered taxable income.