Valid Deed in Lieu of Foreclosure Form for Florida State

In the state of Florida, homeowners facing financial difficulties may find themselves exploring various options to avoid the lengthy and often stressful foreclosure process. One such option is the Deed in Lieu of Foreclosure, a legal arrangement that allows a homeowner to voluntarily transfer the ownership of their property back to the lender. This form serves as a crucial document in this process, outlining the terms under which the property is surrendered. It can help homeowners escape the negative impacts of foreclosure on their credit score and provide a more dignified exit from homeownership. By signing this form, the homeowner typically relinquishes any claims to the property while the lender agrees to release them from the mortgage obligation. This agreement can also include provisions for the homeowner to remain in the property for a limited time after the transfer, providing a buffer period to transition to new living arrangements. Understanding the nuances of this form, including its benefits and potential drawbacks, is essential for anyone considering this route as a solution to their financial challenges.

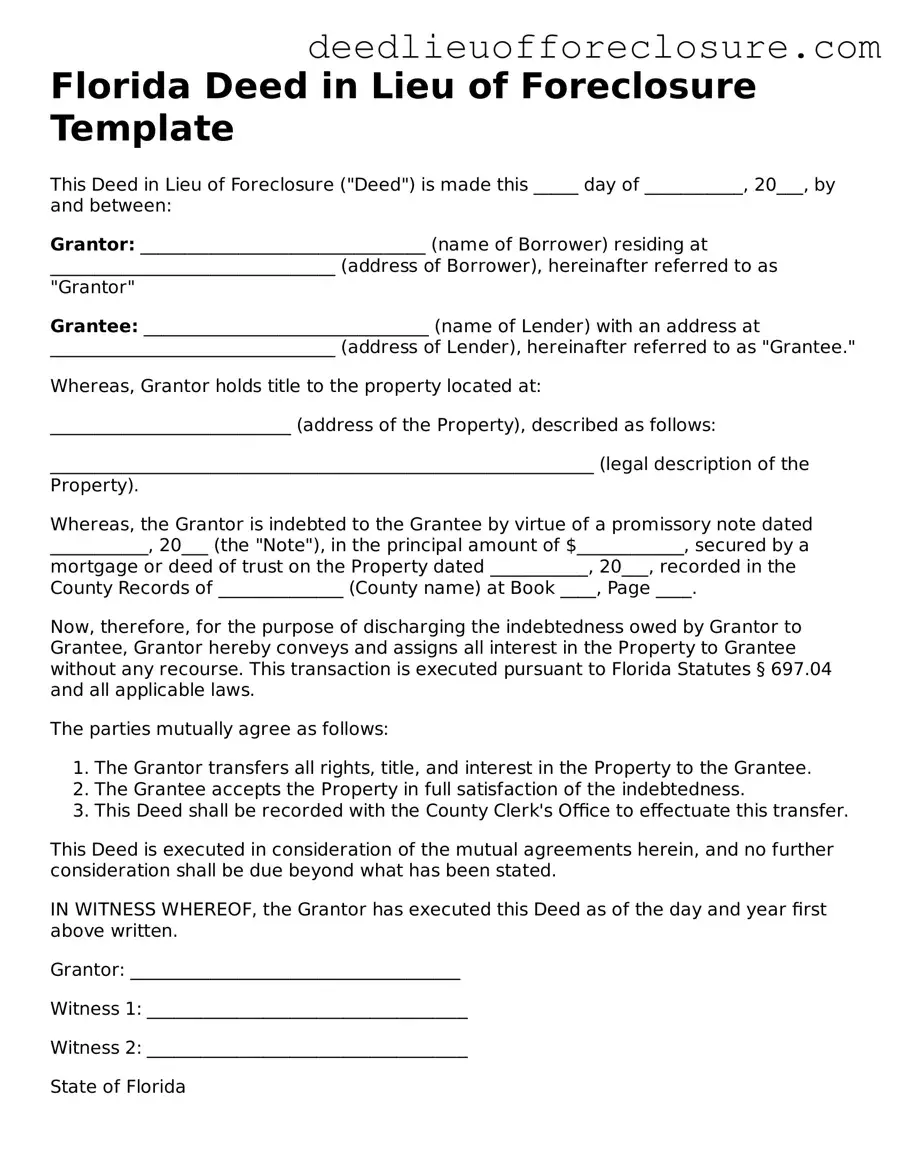

Document Preview Example

Florida Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure ("Deed") is made this _____ day of ___________, 20___, by and between:

Grantor: ________________________________ (name of Borrower) residing at ________________________________ (address of Borrower), hereinafter referred to as "Grantor"

Grantee: ________________________________ (name of Lender) with an address at ________________________________ (address of Lender), hereinafter referred to as "Grantee."

Whereas, Grantor holds title to the property located at:

___________________________ (address of the Property), described as follows:

_____________________________________________________________ (legal description of the Property).

Whereas, the Grantor is indebted to the Grantee by virtue of a promissory note dated ___________, 20___ (the "Note"), in the principal amount of $____________, secured by a mortgage or deed of trust on the Property dated ___________, 20___, recorded in the County Records of ______________ (County name) at Book ____, Page ____.

Now, therefore, for the purpose of discharging the indebtedness owed by Grantor to Grantee, Grantor hereby conveys and assigns all interest in the Property to Grantee without any recourse. This transaction is executed pursuant to Florida Statutes § 697.04 and all applicable laws.

The parties mutually agree as follows:

- The Grantor transfers all rights, title, and interest in the Property to the Grantee.

- The Grantee accepts the Property in full satisfaction of the indebtedness.

- This Deed shall be recorded with the County Clerk's Office to effectuate this transfer.

This Deed is executed in consideration of the mutual agreements herein, and no further consideration shall be due beyond what has been stated.

IN WITNESS WHEREOF, the Grantor has executed this Deed as of the day and year first above written.

Grantor: _____________________________________

Witness 1: ____________________________________

Witness 2: ____________________________________

State of Florida

County of ________________

On this _____ day of ___________, 20___, before me, a notary public, personally appeared ___________________________________ (Grantor's name), known to me (or proved to me on the basis of satisfactory evidence) to be the person(s) whose name(s) is/are subscribed to this instrument and acknowledged that he/she/they executed it.

Notary Public: ____________________________________

My Commission Expires: ____________________________

PDF Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Purpose | This process helps borrowers avoid the lengthy and often costly foreclosure process while allowing lenders to recover their investment more quickly. |

| Governing Law | The deed in lieu of foreclosure in Florida is governed by state laws, primarily under Florida Statutes Chapter 697. |

| Eligibility | Typically, borrowers facing financial difficulties and unable to meet mortgage obligations may qualify for this option, but lender approval is required. |

| Advantages | Borrowers can avoid foreclosure, minimize credit damage, and potentially negotiate a deficiency waiver with the lender. |

| Disadvantages | Borrowers may still face tax implications on forgiven debt, and lenders may require the borrower to vacate the property quickly. |

| Process | The process generally involves negotiating terms with the lender, signing the deed, and ensuring that any liens or encumbrances are addressed. |

| Impact on Credit | A deed in lieu of foreclosure may have a less severe impact on a borrower's credit score compared to a full foreclosure. |

Dos and Don'ts

When filling out the Florida Deed in Lieu of Foreclosure form, it's important to approach the process with care. Here are five essential do's and don'ts to keep in mind:

- Do ensure that all parties involved are clearly identified, including the borrower and lender.

- Do provide accurate property information, including the legal description and address.

- Do review the document thoroughly before signing to avoid any mistakes.

- Don't rush through the process; take your time to understand each section of the form.

- Don't forget to consult with a legal professional if you have any questions or concerns.

By following these guidelines, you can navigate the process more smoothly and ensure that your Deed in Lieu of Foreclosure is completed correctly.

Other Common State-specific Deed in Lieu of Foreclosure Forms

Deed in Lieu of Mortgage - This form of property transfer requires clear communication between homeowner and lender.

Deed in Lieu of Foreclosure Sample - This alternative can provide emotional relief by eliminating the burden of an impending foreclosure.

Foreclosure in Georgia - This document protects homeowners from further collection actions after the transfer of property.

Foreclosure Vs Deed in Lieu - Used when a borrower cannot keep making payments and wants to avoid foreclosure proceedings.

Key takeaways

Filling out and using the Florida Deed in Lieu of Foreclosure form can be a straightforward process if you keep a few key points in mind. Here are some important takeaways:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows you to transfer ownership of your property to the lender to avoid foreclosure.

- Eligibility Requirements: You must be the legal owner of the property and be facing financial hardship to qualify.

- Consult with a Professional: It's wise to seek advice from a real estate attorney or a financial advisor before proceeding.

- Review Your Mortgage: Check your mortgage documents for any clauses related to a Deed in Lieu of Foreclosure.

- Gather Necessary Documents: Prepare to provide financial information, property details, and any correspondence with your lender.

- Complete the Form Accurately: Fill out the form carefully. Mistakes can delay the process or lead to rejection.

- Negotiate with Your Lender: Discuss the terms with your lender. They may have specific requirements or conditions.

- Understand the Consequences: A Deed in Lieu can impact your credit score, so be aware of the long-term effects.

- Keep Copies: Always keep copies of the signed deed and any related documents for your records.

By following these takeaways, you can navigate the Deed in Lieu of Foreclosure process more effectively and make informed decisions about your property.