Valid Deed in Lieu of Foreclosure Form for Georgia State

In the state of Georgia, homeowners facing financial difficulties may find themselves exploring various options to avoid foreclosure. One such option is the Deed in Lieu of Foreclosure, a legal document that allows a homeowner to voluntarily transfer the title of their property to the lender. This process can provide a smoother and less stressful alternative to foreclosure, potentially helping to mitigate the negative impact on the homeowner's credit score. By executing this form, the homeowner relinquishes ownership of the property, while the lender agrees to cancel the mortgage debt. This arrangement can be beneficial for both parties, as it often allows the lender to recover their investment more efficiently and offers the homeowner a way to exit their financial obligations without the lengthy and costly foreclosure process. Understanding the key components of the Georgia Deed in Lieu of Foreclosure form, including the necessary requirements, potential benefits, and implications, is essential for any homeowner considering this option. Being informed can empower individuals to make decisions that align with their financial goals and circumstances.

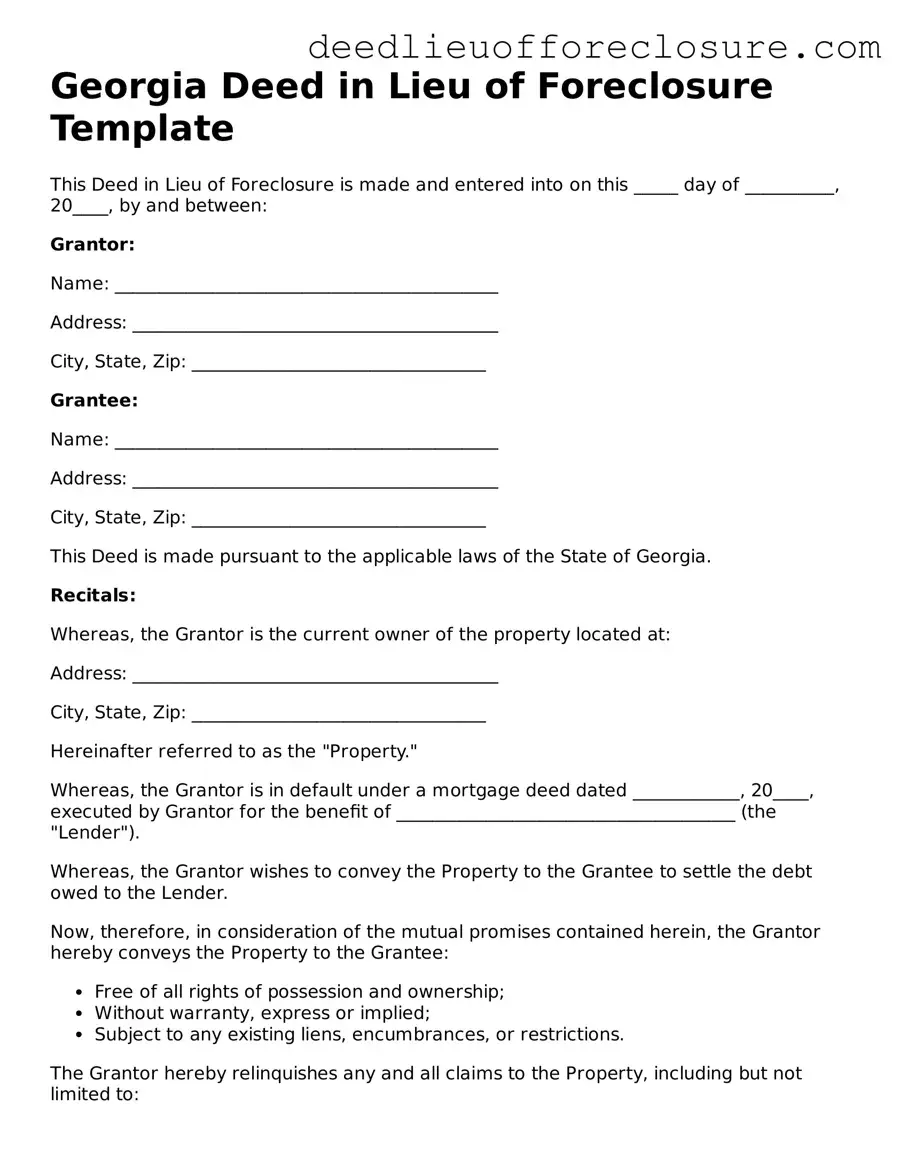

Document Preview Example

Georgia Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made and entered into on this _____ day of __________, 20____, by and between:

Grantor:

Name: ___________________________________________

Address: _________________________________________

City, State, Zip: _________________________________

Grantee:

Name: ___________________________________________

Address: _________________________________________

City, State, Zip: _________________________________

This Deed is made pursuant to the applicable laws of the State of Georgia.

Recitals:

Whereas, the Grantor is the current owner of the property located at:

Address: _________________________________________

City, State, Zip: _________________________________

Hereinafter referred to as the "Property."

Whereas, the Grantor is in default under a mortgage deed dated ____________, 20____, executed by Grantor for the benefit of ______________________________________ (the "Lender").

Whereas, the Grantor wishes to convey the Property to the Grantee to settle the debt owed to the Lender.

Now, therefore, in consideration of the mutual promises contained herein, the Grantor hereby conveys the Property to the Grantee:

- Free of all rights of possession and ownership;

- Without warranty, express or implied;

- Subject to any existing liens, encumbrances, or restrictions.

The Grantor hereby relinquishes any and all claims to the Property, including but not limited to:

- Any rights to redeem the Property;

- Any claims for damages or compensation against Grantee.

This Deed shall be recorded in the office of the Clerk of Superior Court in _____________ County, Georgia.

In Witness Whereof, the Grantor has executed this Deed as of the day and year first above written.

__________________________ (Grantor’s Signature)

__________________________ (Printed Name)

__________________________ (Grantee’s Signature)

__________________________ (Printed Name)

State of Georgia

County of ________________________

Subscribed and sworn to before me this _____ day of __________, 20____.

__________________________ (Notary Public)

My Commission Expires: _____________

PDF Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Laws | The process is governed by Georgia law, specifically O.C.G.A. § 44-14-162.2. |

| Eligibility | Homeowners facing financial difficulties may be eligible, but they must have the lender's approval. |

| Benefits | This option can help borrowers avoid the lengthy foreclosure process and potentially reduce negative credit impacts. |

| Process | The borrower must negotiate terms with the lender and complete the deed transfer, often requiring legal assistance. |

| Consequences | While it may relieve the borrower from the mortgage obligation, it may still affect their credit score. |

Dos and Don'ts

When filling out the Georgia Deed in Lieu of Foreclosure form, it is essential to approach the process with care. Here are some important dos and don’ts to consider:

- Do ensure that all parties involved in the transaction are clearly identified.

- Do provide accurate and complete information about the property.

- Do review the form carefully for any errors before submission.

- Do consult with a legal professional if you have any questions about the process.

- Don’t rush through the form; take your time to understand each section.

- Don’t leave any fields blank unless instructed to do so.

- Don’t sign the form without ensuring that all required parties are present.

- Don’t forget to keep a copy of the completed form for your records.

Other Common State-specific Deed in Lieu of Foreclosure Forms

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Completing this form signifies that the homeowner relinquishes all rights to the property in exchange for mortgage forgiveness.

Deed in Lieu of Mortgage - The lender accepts the deed instead of pursuing legal foreclosure action.

Deed in Lieu of Foreclosure Ny - This document helps simplify the process of settling a mortgage when property cannot be kept.

California Pre-foreclosure Property Transfer - The documentation reflects a voluntary agreement between the borrower and the lender to settle the mortgage debt without court intervention.

Key takeaways

When considering the Georgia Deed in Lieu of Foreclosure form, it is essential to understand its implications and requirements. Here are key takeaways to keep in mind:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to transfer property ownership to the lender to avoid foreclosure.

- Eligibility Requirements: Ensure that you meet the lender's criteria, which may include demonstrating financial hardship and attempting to sell the property.

- Consult a Professional: It is advisable to seek legal or financial advice before proceeding to ensure you understand the consequences.

- Gather Necessary Documents: Collect all required documents, including the mortgage agreement and any correspondence with the lender.

- Complete the Form Accurately: Fill out the form with precise information to avoid delays or complications in the process.

- Review the Terms: Carefully read the terms outlined in the deed to understand your rights and obligations post-transfer.

- File with the County: Once completed, submit the deed to the local county office to officially record the transfer of ownership.

Taking these steps can help ensure a smoother process when using the Georgia Deed in Lieu of Foreclosure form.