Valid Deed in Lieu of Foreclosure Form for Illinois State

In Illinois, property owners facing financial distress may find relief through the Deed in Lieu of Foreclosure form. This legal document serves as a voluntary agreement between a borrower and a lender, allowing the borrower to transfer ownership of their property to the lender in exchange for the cancellation of the mortgage debt. This process can streamline the resolution of a foreclosure situation, enabling homeowners to avoid the lengthy and often costly court proceedings associated with traditional foreclosure. The form outlines key details, including the property description, the parties involved, and the terms of the transfer. By executing this deed, the borrower relinquishes their rights to the property, while the lender agrees to accept the property in lieu of pursuing foreclosure. This arrangement can benefit both parties, as it allows the borrower to mitigate damage to their credit score and the lender to recover their investment more efficiently. Understanding the implications and procedures associated with the Deed in Lieu of Foreclosure is crucial for homeowners navigating financial difficulties in Illinois.

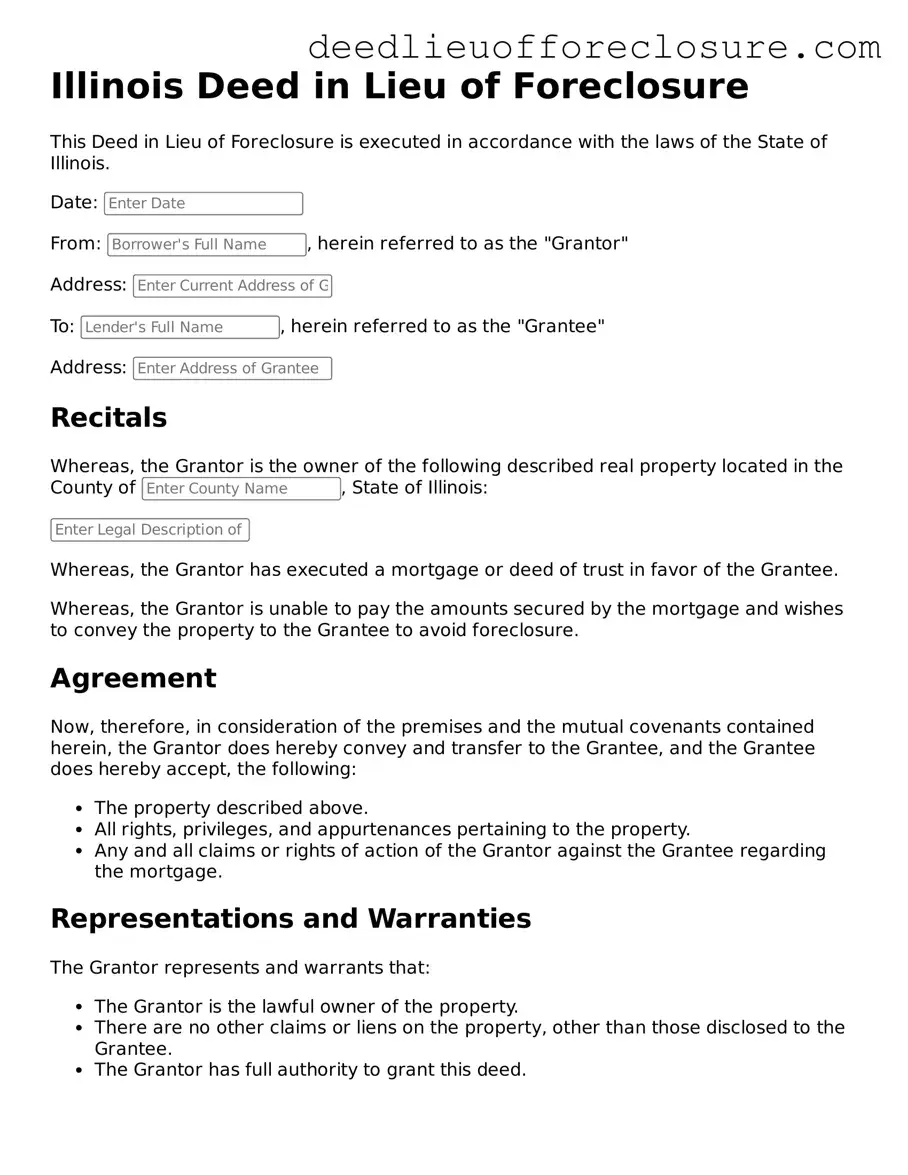

Document Preview Example

Illinois Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is executed in accordance with the laws of the State of Illinois.

Date:

From: , herein referred to as the "Grantor"

Address:

To: , herein referred to as the "Grantee"

Address:

Recitals

Whereas, the Grantor is the owner of the following described real property located in the County of , State of Illinois:

Whereas, the Grantor has executed a mortgage or deed of trust in favor of the Grantee.

Whereas, the Grantor is unable to pay the amounts secured by the mortgage and wishes to convey the property to the Grantee to avoid foreclosure.

Agreement

Now, therefore, in consideration of the premises and the mutual covenants contained herein, the Grantor does hereby convey and transfer to the Grantee, and the Grantee does hereby accept, the following:

- The property described above.

- All rights, privileges, and appurtenances pertaining to the property.

- Any and all claims or rights of action of the Grantor against the Grantee regarding the mortgage.

Representations and Warranties

The Grantor represents and warrants that:

- The Grantor is the lawful owner of the property.

- There are no other claims or liens on the property, other than those disclosed to the Grantee.

- The Grantor has full authority to grant this deed.

Acceptance

The Grantee accepts this deed, which shall be effective upon execution by the Grantor.

Signatures

Executed this day of , .

Grantor’s Signature: ___________________________

Grantor's Printed Name:

Grantee’s Signature: ___________________________

Grantee's Printed Name:

This Deed in Lieu of Foreclosure is executed voluntarily and with knowledge of its consequences.

PDF Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | In Illinois, the deed in lieu of foreclosure is governed by the Illinois Mortgage Foreclosure Law, primarily found in 735 ILCS 5/15. |

| Eligibility | Homeowners facing financial difficulties and unable to keep up with mortgage payments may be eligible for this option. |

| Benefits | This process can help borrowers avoid the lengthy foreclosure process and may have less impact on their credit score. |

| Process | To initiate, the borrower must contact the lender, provide necessary documentation, and agree to the terms of the deed transfer. |

| Potential Drawbacks | Borrowers may still be liable for any remaining mortgage debt if the property value is less than the loan amount. |

| Legal Considerations | It is advisable for borrowers to seek legal advice before proceeding, as the deed in lieu may have implications on future homeownership and credit. |

Dos and Don'ts

When filling out the Illinois Deed in Lieu of Foreclosure form, it is important to follow specific guidelines to ensure the process goes smoothly. Below are four things to do and not do during this process.

- Do: Ensure all property details are accurate and complete.

- Do: Include the names of all parties involved in the transaction.

- Do: Sign the document in the presence of a notary public.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any sections of the form blank.

- Don't: Use outdated or incorrect forms; always use the latest version.

- Don't: Forget to check for any local requirements that may apply.

- Don't: Rush through the process; take your time to review everything carefully.

Other Common State-specific Deed in Lieu of Foreclosure Forms

Deed in Lieu of Foreclosure Ny - This approach can potentially save both parties time, money, and effort.

Foreclosure in Georgia - It enables property owners to avoid the emotional and financial stress of foreclosure proceedings.

Foreclosure Vs Deed in Lieu - The deed can limit the negative impacts on credit reports compared to foreclosure.

Deed in Lieu of Mortgage - The lender may require a title search to confirm there are no other claims on the property.

Key takeaways

When considering a Deed in Lieu of Foreclosure in Illinois, there are several important factors to keep in mind. Here are key takeaways to help you navigate the process:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure. This can be a less stressful option for both parties.

- Eligibility Requirements: Not all homeowners qualify. Lenders typically require that the borrower is unable to make mortgage payments and that the property is in good condition.

- Consult Your Lender: Before filling out the form, it’s essential to communicate with your lender. They can provide guidance on the process and any specific requirements they may have.

- Complete the Form Accurately: Fill out the Deed in Lieu of Foreclosure form carefully. Ensure all information is correct to avoid delays or complications.

- Consider Legal Advice: Seeking advice from a legal professional can be beneficial. They can help you understand the implications of the deed and ensure your rights are protected.

Taking these steps can make the process smoother and help you make informed decisions regarding your property and financial future.