Valid Deed in Lieu of Foreclosure Form for New York State

The Deed in Lieu of Foreclosure form serves as a crucial instrument for property owners in New York facing financial distress and the potential loss of their homes. This legal document enables a homeowner to voluntarily transfer ownership of their property back to the lender, thereby avoiding the lengthy and often costly foreclosure process. By executing this form, the homeowner relinquishes their rights to the property, while the lender agrees to accept the deed in satisfaction of the mortgage debt. This arrangement can provide a more amicable resolution for both parties, as it often allows the borrower to escape the negative consequences of foreclosure, such as damage to credit scores and the emotional toll associated with losing a home. Additionally, the Deed in Lieu of Foreclosure can streamline the transition for the lender, who may prefer this method to expedite the recovery of their investment. It is essential for homeowners to understand the implications of signing this document, including the potential tax consequences and the impact on future borrowing ability. Overall, the Deed in Lieu of Foreclosure form represents a strategic option for those seeking to navigate the complexities of financial hardship while minimizing adverse outcomes.

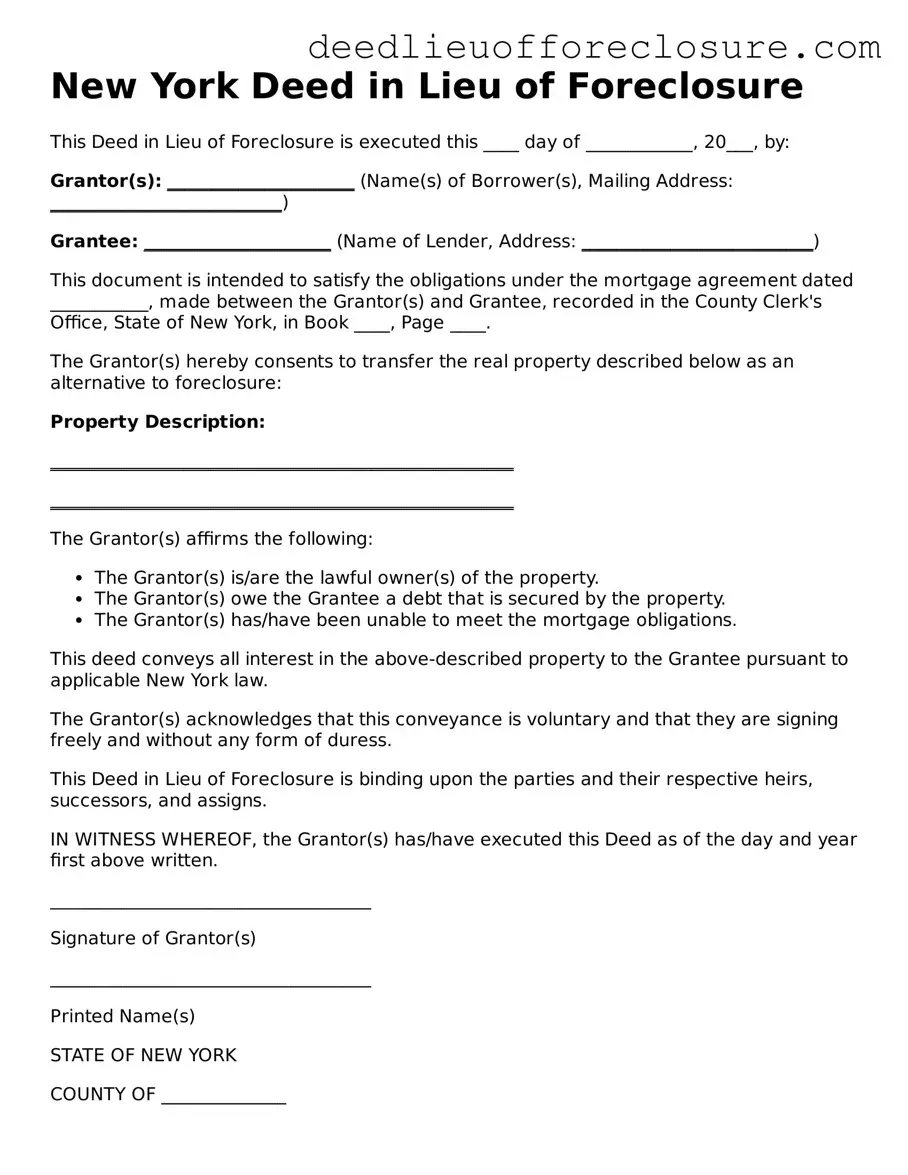

Document Preview Example

New York Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is executed this ____ day of ____________, 20___, by:

Grantor(s): _____________________ (Name(s) of Borrower(s), Mailing Address: __________________________)

Grantee: _____________________ (Name of Lender, Address: __________________________)

This document is intended to satisfy the obligations under the mortgage agreement dated ___________, made between the Grantor(s) and Grantee, recorded in the County Clerk's Office, State of New York, in Book ____, Page ____.

The Grantor(s) hereby consents to transfer the real property described below as an alternative to foreclosure:

Property Description:

____________________________________________________

____________________________________________________

The Grantor(s) affirms the following:

- The Grantor(s) is/are the lawful owner(s) of the property.

- The Grantor(s) owe the Grantee a debt that is secured by the property.

- The Grantor(s) has/have been unable to meet the mortgage obligations.

This deed conveys all interest in the above-described property to the Grantee pursuant to applicable New York law.

The Grantor(s) acknowledges that this conveyance is voluntary and that they are signing freely and without any form of duress.

This Deed in Lieu of Foreclosure is binding upon the parties and their respective heirs, successors, and assigns.

IN WITNESS WHEREOF, the Grantor(s) has/have executed this Deed as of the day and year first above written.

____________________________________

Signature of Grantor(s)

____________________________________

Printed Name(s)

STATE OF NEW YORK

COUNTY OF ______________

On this ____ day of ____________, 20___, before me, a notary public in and for said state, personally appeared ____________________ (Name of Grantor(s)), known to me to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that they executed the same.

____________________________________

Notary Public

PDF Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | In New York, this process is governed by the New York Real Property Actions and Proceedings Law (RPAPL). |

| Purpose | The primary purpose is to settle a mortgage default without going through the lengthy foreclosure process. |

| Eligibility | Homeowners facing financial difficulties may qualify, provided they have no other liens on the property. |

| Benefits | It can help borrowers avoid the negative impacts of foreclosure on their credit score. |

| Process | The borrower must contact the lender to discuss the possibility and negotiate terms. |

| Documentation | Both parties must sign the Deed in Lieu of Foreclosure, and the borrower should ensure all necessary documents are in order. |

| Potential Risks | There may be tax implications, as the IRS could consider forgiven debt as taxable income. |

| Impact on Credit | A Deed in Lieu typically has a less severe impact on a borrower's credit score compared to a foreclosure. |

| Alternatives | Options such as loan modification or short sale may also be considered before deciding on a Deed in Lieu. |

Dos and Don'ts

When filling out the New York Deed in Lieu of Foreclosure form, there are important guidelines to follow. Here’s a list of things to do and avoid:

- Do ensure all information is accurate and complete. Double-check names, addresses, and legal descriptions of the property.

- Do consult with a legal professional if you have any questions. Understanding the implications of this document is crucial.

- Do sign the document in the presence of a notary public. This step is necessary for the deed to be legally binding.

- Do keep a copy of the completed form for your records. This will be important for future reference.

- Don't rush through the form. Take your time to ensure everything is filled out correctly.

- Don't forget to check for any additional requirements specific to your situation. Each case may have unique aspects to consider.

- Don't leave any sections blank unless instructed. Missing information can delay the process.

- Don't ignore the potential tax implications. Understanding how this deed may affect your taxes is important.

Other Common State-specific Deed in Lieu of Foreclosure Forms

Deed in Lieu Vs Foreclosure - Some lenders may require the homeowner to vacate the property immediately after the deed is signed.

California Pre-foreclosure Property Transfer - This document can offer both parties—borrower and lender—a more amicable solution, preserving relationships and reputational interests.

Key takeaways

Filling out and using the New York Deed in Lieu of Foreclosure form requires careful attention to detail. Here are some key takeaways to consider:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a borrower to transfer property ownership to the lender to avoid foreclosure.

- Eligibility Criteria: Ensure you meet the lender's requirements, which may include being unable to make mortgage payments and having a property free of other liens.

- Consult Legal Advice: It is advisable to seek legal counsel to understand the implications of signing the deed and to protect your interests.

- Gather Necessary Documents: Collect all relevant documents, including the mortgage agreement and any correspondence with the lender.

- Complete the Form Accurately: Fill out the form with precise information, including property details and borrower information.

- Review Terms and Conditions: Carefully read the terms associated with the deed to understand your rights and responsibilities post-transfer.

- File the Deed Correctly: After signing, ensure the deed is filed with the appropriate county office to officially transfer ownership.

Being informed about these aspects can help streamline the process and mitigate potential issues.