Valid Deed in Lieu of Foreclosure Form for Ohio State

In Ohio, homeowners facing financial difficulties may find relief through a Deed in Lieu of Foreclosure, a legal tool that allows them to transfer ownership of their property back to the lender. This process can help avoid the lengthy and often stressful foreclosure proceedings. By voluntarily surrendering the property, homeowners can mitigate the impact on their credit score and potentially negotiate terms that are more favorable than those typically offered in foreclosure. The Deed in Lieu of Foreclosure form outlines the essential details of this transaction, including the identification of the parties involved, a description of the property, and any existing liens. It also addresses the homeowner's intention to relinquish their rights to the property, which can lead to a smoother transition for both the borrower and the lender. Understanding this form is crucial for anyone considering this option, as it can provide a pathway to financial recovery while minimizing legal complications.

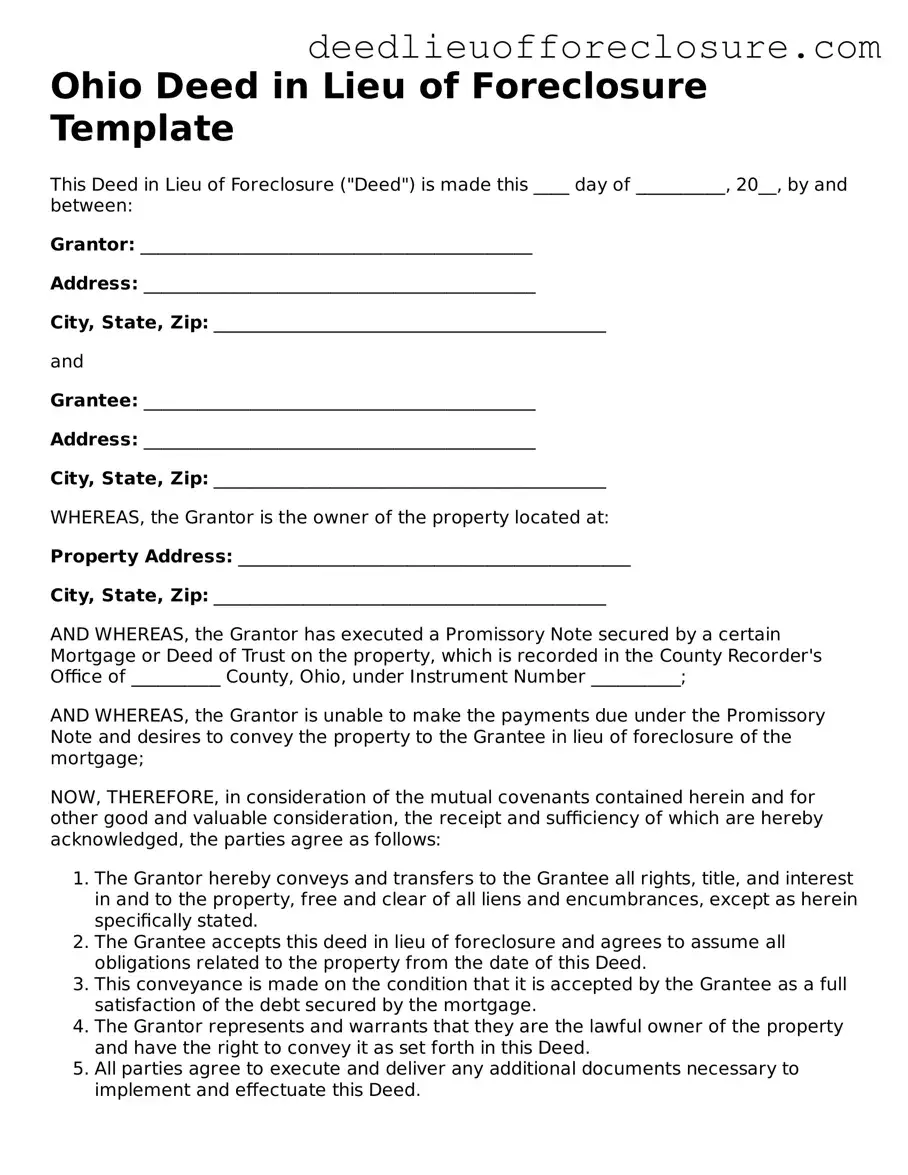

Document Preview Example

Ohio Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure ("Deed") is made this ____ day of __________, 20__, by and between:

Grantor: ____________________________________________

Address: ____________________________________________

City, State, Zip: ____________________________________________

and

Grantee: ____________________________________________

Address: ____________________________________________

City, State, Zip: ____________________________________________

WHEREAS, the Grantor is the owner of the property located at:

Property Address: ____________________________________________

City, State, Zip: ____________________________________________

AND WHEREAS, the Grantor has executed a Promissory Note secured by a certain Mortgage or Deed of Trust on the property, which is recorded in the County Recorder's Office of __________ County, Ohio, under Instrument Number __________;

AND WHEREAS, the Grantor is unable to make the payments due under the Promissory Note and desires to convey the property to the Grantee in lieu of foreclosure of the mortgage;

NOW, THEREFORE, in consideration of the mutual covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

- The Grantor hereby conveys and transfers to the Grantee all rights, title, and interest in and to the property, free and clear of all liens and encumbrances, except as herein specifically stated.

- The Grantee accepts this deed in lieu of foreclosure and agrees to assume all obligations related to the property from the date of this Deed.

- This conveyance is made on the condition that it is accepted by the Grantee as a full satisfaction of the debt secured by the mortgage.

- The Grantor represents and warrants that they are the lawful owner of the property and have the right to convey it as set forth in this Deed.

- All parties agree to execute and deliver any additional documents necessary to implement and effectuate this Deed.

IN WITNESS WHEREOF, the parties hereto have executed this Deed as of the date first above written.

Grantor: ____________________________________________

Grantee: ____________________________________________

STATE OF OHIO, COUNTY OF __________

Before me, a Notary Public in and for said County and State, personally appeared ____________________________________________, who acknowledged that they executed the foregoing Deed in Lieu of Foreclosure for the purposes therein contained.

WITNESS my hand and official seal this ____ day of __________, 20__.

____________________________________

Notary Public

My Commission Expires: _______________

PDF Form Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Deed in Lieu of Foreclosure form allows a borrower to transfer property ownership to the lender to avoid foreclosure proceedings. |

| Governing Law | This form is governed by the Ohio Revised Code, specifically sections related to foreclosure and property transfer. |

| Eligibility | Homeowners facing financial difficulties may qualify for this option, provided they have exhausted other alternatives. |

| Benefits | Completing this form can lead to a quicker resolution, less impact on credit scores, and potential debt forgiveness. |

| Process | The borrower must submit the form to the lender, who will review the request and may accept the deed in exchange for releasing the borrower from the mortgage obligation. |

Dos and Don'ts

When filling out the Ohio Deed in Lieu of Foreclosure form, it is important to follow certain guidelines to ensure the process goes smoothly. Here are some essential do's and don'ts:

- Do provide accurate property information, including the legal description and address.

- Do ensure all parties involved sign the document where required.

- Do keep a copy of the completed form for your records.

- Do consult with a legal professional if you have any questions about the process.

- Don't leave any sections of the form blank; all fields must be completed.

- Don't use outdated forms; always use the latest version available.

- Don't forget to notarize the document, as this is often a requirement.

- Don't rush through the process; take your time to ensure everything is correct.

Other Common State-specific Deed in Lieu of Foreclosure Forms

Deed in Lieu of Foreclosure Ny - It can help homeowners quickly resolve issues associated with a distressed property.

Foreclosure Vs Deed in Lieu - A quick way to resolve property ownership issues without a court action.

Deed in Lieu of Forclosure - The deed transfers title from the borrower to the lender, thus canceling the mortgage debt associated with the property.

Key takeaways

Filling out and using the Ohio Deed in Lieu of Foreclosure form is a significant step for homeowners facing financial difficulties. Here are some key takeaways to consider:

- The deed in lieu of foreclosure allows a homeowner to voluntarily transfer property ownership to the lender to avoid foreclosure.

- It is crucial to consult with a housing counselor or attorney before proceeding to ensure this option is right for your situation.

- Gather all necessary documents, including the mortgage agreement and any relevant financial information, to streamline the process.

- The form must be filled out completely and accurately to prevent delays or complications.

- Both the homeowner and the lender must sign the form for it to be legally binding.

- Be aware that this action may impact your credit score, but it is often less damaging than a foreclosure.

- After submitting the deed, ensure you receive confirmation from the lender that the property has been transferred.

- Keep copies of all documents related to the deed in lieu for your records.

- Consider the tax implications of a deed in lieu, as it may be treated as income by the IRS.