Valid Deed in Lieu of Foreclosure Form for Pennsylvania State

The Pennsylvania Deed in Lieu of Foreclosure form serves as a significant legal instrument for homeowners facing financial difficulties and potential foreclosure. This form allows property owners to voluntarily transfer the title of their property back to the lender, thereby avoiding the lengthy and often stressful foreclosure process. By executing this deed, homeowners may mitigate the negative impact on their credit and potentially negotiate favorable terms with their lender. The process typically involves the homeowner providing a written request to the lender, detailing their financial situation and the reasons for the deed. Lenders, in turn, must evaluate the request and decide whether to accept the deed as a viable alternative to foreclosure. This agreement can also include terms related to any remaining mortgage balance, allowing for a smoother transition for the homeowner. Understanding the implications and requirements of this form is essential for both parties involved, as it can lead to a more amicable resolution in challenging financial circumstances.

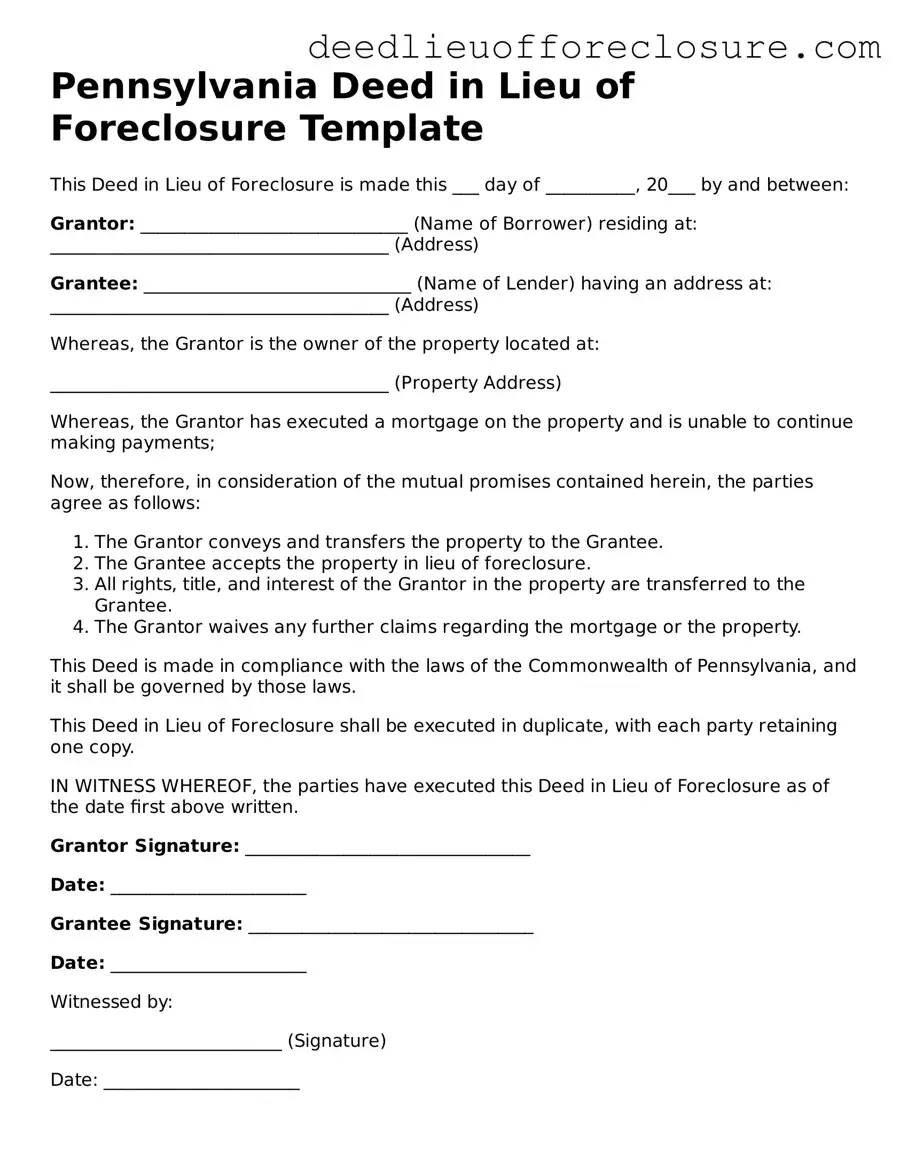

Document Preview Example

Pennsylvania Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made this ___ day of __________, 20___ by and between:

Grantor: ______________________________ (Name of Borrower) residing at: ______________________________________ (Address)

Grantee: ______________________________ (Name of Lender) having an address at: ______________________________________ (Address)

Whereas, the Grantor is the owner of the property located at:

______________________________________ (Property Address)

Whereas, the Grantor has executed a mortgage on the property and is unable to continue making payments;

Now, therefore, in consideration of the mutual promises contained herein, the parties agree as follows:

- The Grantor conveys and transfers the property to the Grantee.

- The Grantee accepts the property in lieu of foreclosure.

- All rights, title, and interest of the Grantor in the property are transferred to the Grantee.

- The Grantor waives any further claims regarding the mortgage or the property.

This Deed is made in compliance with the laws of the Commonwealth of Pennsylvania, and it shall be governed by those laws.

This Deed in Lieu of Foreclosure shall be executed in duplicate, with each party retaining one copy.

IN WITNESS WHEREOF, the parties have executed this Deed in Lieu of Foreclosure as of the date first above written.

Grantor Signature: ________________________________

Date: ______________________

Grantee Signature: ________________________________

Date: ______________________

Witnessed by:

__________________________ (Signature)

Date: ______________________

PDF Form Breakdown

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document allowing a homeowner to transfer property ownership to the lender to avoid foreclosure proceedings. |

| Governing Law | This form is governed by Pennsylvania state law, particularly under the Pennsylvania Uniform Commercial Code. |

| Eligibility | Homeowners facing financial difficulties and unable to keep up with mortgage payments may qualify for this option. |

| Benefits | A Deed in Lieu can help homeowners avoid the lengthy and stressful foreclosure process, allowing for a quicker resolution. |

| Impact on Credit | While a Deed in Lieu is less damaging than a foreclosure, it can still negatively affect a homeowner's credit score. |

| Process | The process typically involves negotiating with the lender, completing the deed form, and transferring the property title. |

| Tax Implications | Homeowners may face tax consequences, as the IRS may consider forgiven mortgage debt as taxable income. |

| Title Issues | It is essential to ensure that the property title is clear of any liens or encumbrances before executing the deed. |

| Legal Advice | Consulting with a legal professional is highly recommended to understand the implications and ensure proper execution. |

| Alternatives | Other options include loan modifications, short sales, or bankruptcy, which may be more suitable depending on individual circumstances. |

Dos and Don'ts

When filling out the Pennsylvania Deed in Lieu of Foreclosure form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are nine essential dos and don'ts:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information about the property.

- Do include all necessary signatures from all parties involved.

- Do ensure the form is notarized as required by Pennsylvania law.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank unless specified.

- Don't use incorrect legal descriptions of the property.

- Don't forget to check for any additional documents that may be required.

- Don't rush the process; take your time to avoid mistakes.

Other Common State-specific Deed in Lieu of Foreclosure Forms

Deed in Lieu of Foreclosure Ny - The document provides a legal method for a voluntary property transfer to the lender.

Foreclosure in Georgia - It serves as a legally binding agreement to sign over property ownership to the lender.

Key takeaways

When considering the Pennsylvania Deed in Lieu of Foreclosure, there are several important aspects to keep in mind. This process can provide a way to avoid foreclosure, but it requires careful attention to detail. Here are some key takeaways:

- Understanding the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to transfer their property to the lender to avoid foreclosure. This can help protect your credit score and provide a smoother transition.

- Eligibility Criteria: Not all homeowners qualify. Lenders typically require that you are facing financial hardship and that the property is not subject to other liens.

- Consulting with Professionals: It is advisable to seek guidance from a real estate attorney or a financial advisor before proceeding. They can help you understand the implications and ensure you make informed decisions.

- Property Condition: The condition of your property matters. Lenders may require an inspection to assess its value and condition before accepting a deed in lieu.

- Gathering Necessary Documents: You will need to provide various documents, including proof of income, tax returns, and any relevant financial statements. Having these ready can expedite the process.

- Negotiating Terms: You may have the opportunity to negotiate the terms of the deed with your lender. This can include discussing potential forgiveness of remaining debt.

- Understanding Tax Implications: Transferring your property may have tax consequences. It is crucial to understand how this could affect your financial situation moving forward.

- Timing is Key: The sooner you initiate the process, the better. Delaying can lead to additional complications or missed opportunities.

- Finalizing the Deed: Once the lender accepts the deed, ensure that all paperwork is properly executed and filed with the county. This step is essential to finalize the transfer.

- Post-Transfer Considerations: After the deed is transferred, stay in touch with your lender. Confirm that all obligations are settled and understand any remaining responsibilities.

By keeping these points in mind, you can navigate the process of filling out and using the Pennsylvania Deed in Lieu of Foreclosure with greater confidence. It's important to approach this situation thoughtfully and to seek support when needed.