Valid Deed in Lieu of Foreclosure Form for Texas State

The Texas Deed in Lieu of Foreclosure form serves as a significant legal instrument for homeowners facing financial difficulties and potential foreclosure. This form allows a homeowner to voluntarily transfer the title of their property back to the lender in exchange for the cancellation of the mortgage debt. By utilizing this process, homeowners can avoid the lengthy and often stressful foreclosure proceedings. The form outlines essential details, including the identification of the parties involved, the property description, and any existing liens or encumbrances. Additionally, it addresses the potential consequences of the transfer, such as the impact on the homeowner's credit score and the possibility of deficiency judgments. Importantly, the Deed in Lieu of Foreclosure can provide a pathway for homeowners to regain financial stability while allowing lenders to recover their investment without resorting to foreclosure. Understanding the implications and requirements of this form is crucial for anyone considering this option as a means to address their mortgage challenges.

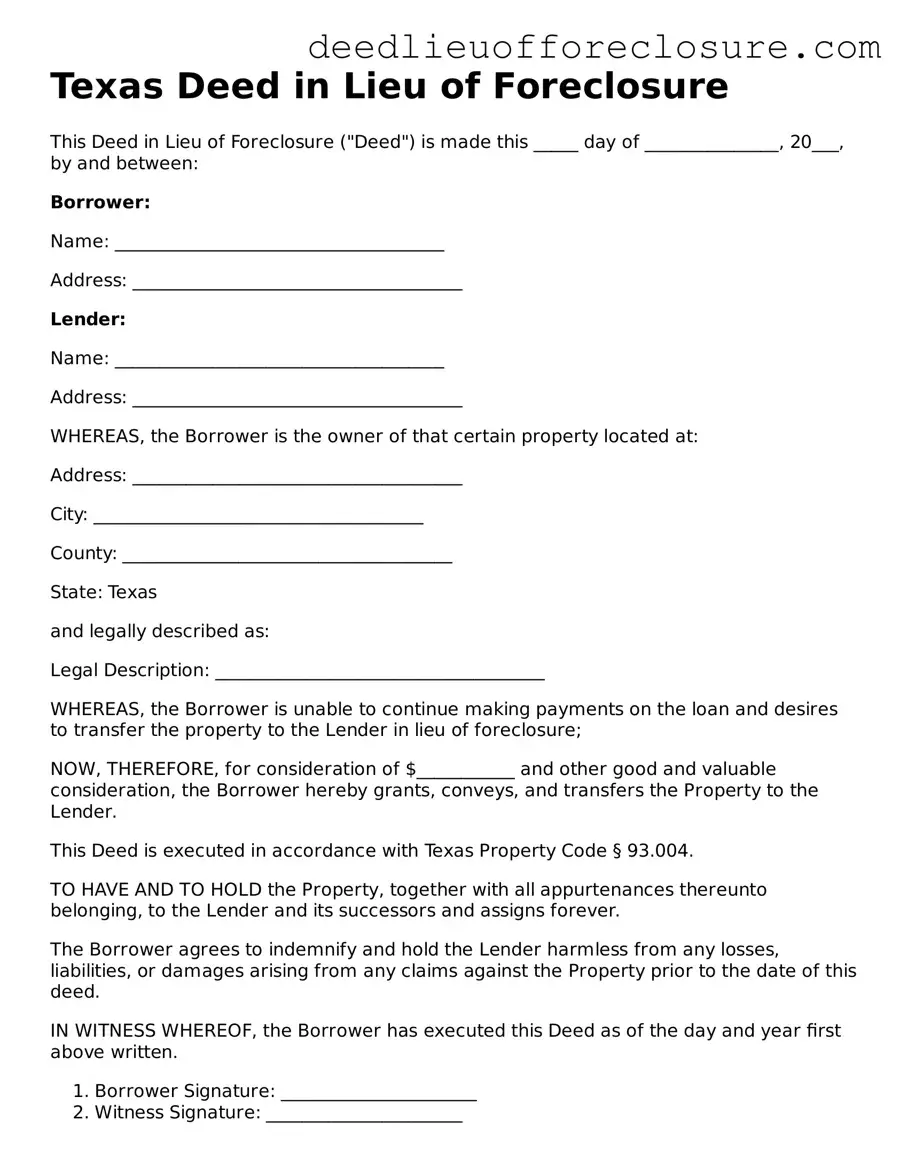

Document Preview Example

Texas Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure ("Deed") is made this _____ day of _______________, 20___, by and between:

Borrower:

Name: _____________________________________

Address: _____________________________________

Lender:

Name: _____________________________________

Address: _____________________________________

WHEREAS, the Borrower is the owner of that certain property located at:

Address: _____________________________________

City: _____________________________________

County: _____________________________________

State: Texas

and legally described as:

Legal Description: _____________________________________

WHEREAS, the Borrower is unable to continue making payments on the loan and desires to transfer the property to the Lender in lieu of foreclosure;

NOW, THEREFORE, for consideration of $___________ and other good and valuable consideration, the Borrower hereby grants, conveys, and transfers the Property to the Lender.

This Deed is executed in accordance with Texas Property Code § 93.004.

TO HAVE AND TO HOLD the Property, together with all appurtenances thereunto belonging, to the Lender and its successors and assigns forever.

The Borrower agrees to indemnify and hold the Lender harmless from any losses, liabilities, or damages arising from any claims against the Property prior to the date of this deed.

IN WITNESS WHEREOF, the Borrower has executed this Deed as of the day and year first above written.

- Borrower Signature: ______________________

- Witness Signature: ______________________

- Date: ______________________

STATE OF TEXAS

COUNTY OF ____________________

Before me, the undersigned authority, on this _____ day of _______________, 20___, personally appeared the above-named Borrower, who is known to me or proved to me through identification to be the person whose name is subscribed to this instrument and acknowledged to me that they executed the same for the purposes and consideration therein expressed.

Given under my hand and seal of office, this _____ day of _______________, 20___.

Notary Public Signature: ______________________

My Commission Expires: ______________________

PDF Form Breakdown

| Fact Name | Details |

|---|---|

| Definition | A Deed in Lieu of Foreclosure allows a borrower to voluntarily transfer property ownership to the lender to avoid foreclosure. |

| Purpose | This form helps borrowers avoid the negative consequences of foreclosure by settling their mortgage obligations more amicably. |

| Eligibility | Homeowners facing financial hardship or unable to keep up with mortgage payments may qualify for this option. |

| Governing Law | The Texas Property Code governs the process and requirements for a Deed in Lieu of Foreclosure in Texas. |

| Process | The borrower must negotiate with the lender and complete the deed transfer to finalize the arrangement. |

| Impact on Credit | A Deed in Lieu of Foreclosure typically has a less severe impact on credit scores compared to a foreclosure. |

| Tax Implications | Borrowers may face tax consequences on any forgiven debt, so consulting a tax professional is advisable. |

| Alternatives | Other options include loan modification or short sale, which may also help avoid foreclosure. |

Dos and Don'ts

When dealing with a Texas Deed in Lieu of Foreclosure, it’s essential to approach the process with care. Here’s a guide on what to do and what to avoid.

- Do consult with a legal expert before filling out the form to ensure you understand the implications.

- Do provide accurate and complete information to avoid delays or complications.

- Do communicate with your lender throughout the process to keep them informed.

- Do ensure that you understand the terms and conditions associated with the deed.

- Don’t rush through the paperwork; take your time to review each section carefully.

- Don’t ignore any outstanding debts or obligations that may affect the deed.

- Don’t sign the document without fully understanding what you are agreeing to.

Taking these steps can help make the process smoother and more manageable. Always prioritize informed decision-making when it comes to significant financial actions like a deed in lieu of foreclosure.

Other Common State-specific Deed in Lieu of Foreclosure Forms

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Benefits of a Deed in Lieu also include the chance to negotiate the treatment of remaining mortgage balances.

Deed in Lieu Vs Foreclosure - Means of communication throughout the procedure can facilitate a smoother transaction.

Foreclosure in Georgia - The deed in lieu can assist in establishing a positive path forward after financial hardship.

Key takeaways

When considering a Deed in Lieu of Foreclosure in Texas, there are several important factors to keep in mind. This process can provide a way to avoid the lengthy foreclosure process, but it requires careful attention to detail. Here are key takeaways to consider:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer their property to the lender to satisfy a mortgage debt.

- Eligibility Requirements: Not all homeowners qualify. Lenders typically require that the homeowner is facing financial hardship and unable to continue making mortgage payments.

- Consult with Professionals: It's wise to seek advice from a real estate attorney or a housing counselor before proceeding. They can help clarify your options and ensure you understand the implications.

- Review the Mortgage Agreement: Check your mortgage documents for any clauses that may affect your ability to use a Deed in Lieu of Foreclosure.

- Complete the Form Accurately: Fill out the Deed in Lieu of Foreclosure form carefully. Mistakes can lead to delays or rejection of the request.

- Negotiate Terms: Before signing, discuss with your lender any potential terms regarding the forgiveness of debt and the impact on your credit score.

- Document Everything: Keep copies of all communications and documents related to the Deed in Lieu of Foreclosure. This can be crucial for future reference.

- Understand Tax Implications: Be aware that transferring property through this method may have tax consequences. Consulting a tax advisor is advisable.

- Prepare for the Transition: Once the deed is transferred, be ready to move out and find alternative housing arrangements, as you will no longer own the property.

Taking these steps can help ensure a smoother process and better outcomes when navigating the complexities of a Deed in Lieu of Foreclosure in Texas.